Course

Courses features

Objectives

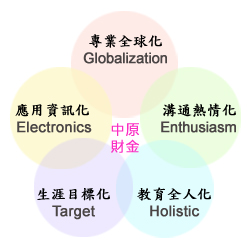

We makes efforts in five objectives, including :

Distinguishing feature | Purpose | Specific training |

Globalization | We are all known that the globalization is unavoidable trend by Financial market and instrument, world wild multi-national corporation and banking. Thus, it is the only way is to enhance English ability and international view to create own advantage. | 1.Professional Financial English courses. |

Electronics | Due to highly development of communication and network, we could receive information quickly from financial market. Therefore how to apply digital software to the analysis of financial in-time information is essential for advancing student’s ability. | 1.Classroom: Digital e-Learning Center. |

Enthusiasm | Group reports are used to nurture their teamwork spirit, communication, collaboration, and enthusiasm. | 1.To bring topic reports into courses. |

Target | Our courses are divided into four modules for planning their future career. Besides, we also provide financial simulated exams for certification to help students sufficiently prepare to the formal ones, which can strengthen their career competence. | The following are our 3 modules : |

Holistics | Ethics and character both are required by financial specialist to make trust for investors, and develop financial field well. Based on this, holistic education is the core point of student’s development. | 1.Courses emphasize both business ethics and social responsibility. |

Innovative and diversified courses

The Department of Finance offers a four-year program leading to the Bachelor degree of Finance. The minimum credits upon graduation are 128, including 91 required credits and 37 elective credits. And the required grade of at least 60 for all courses, in order to be eligible for graduation.

Students need to take at least 34 required subjects of general education credits. School of business offers two-years required subjects of “Practical English” taught by foreign teachers for strengthening the ability of practical foreign language.

The required subject of “Business Ethics” that invited national celebrities making deep speeches enriches ethics of financial personnel.

Besides, the required basic subjects in financial fields include financial management, investment, futures and options, introduction to financial market, bank management, currency and bank, microeconomics, and macroeconomics…etc.

Two modules of the Dept. of Finance are as follows :

Type | Sophomore | Junior | Senior |

Corporate Finance & | Industrial Analysis | Real Estate Economics | Cases in Banking Management |

Investment Banking Management | Public Finance | ||

Financial Institutions Management | Seminar on Financial Holding | ||

Mergers and Acquisitions | Special Topics in International Investment | ||

Financial Product & Financial Market Modules | Security and Financial Regulations | Real Estate Investment Management | International Finance |

Financial Planning and Strategy | Seminar on Financial practice | ||

Fixed Income Instruments | Financial Derivatives | ||

Security Analysis and Investment Management | Seminar on Financial Engineering |

CURRICULA & CREDITS

COURSE NAME | Course Type/Characteristic/Credit | Language |

Mathematical Finance | Core / Half / 3 | Chinese |

Financial Accounting(I) | Core / Half / 3 | Chinese |

Financial Accounting(II) | Core / Half / 3 | Chinese |

Economics(I) | Core / Half / 3 | Chinese |

Economics(I I) | Core / Half / 3 | Chinese |

Management | Core / Half / 3 | Chinese |

Statistics(I) | Core / Half / 3 | Chinese |

Statistics(I I) | Core / Half / 3 | Chinese |

Financial Management(I) | Core / Half / 3 | Chinese |

Financial Management(I I) | Core / Half / 3 | Chinese |

Financial Market | Core / Half / 3 | Chinese |

Money and Banking | Core / Half / 3 | Chinese |

Business English Conversation (I) | Core / Half / 3 | English |

Business English Conversation (II) | Core / Half / 3 | English |

Investment | Core / Half / 3 | Chinese |

Financial Statements Analysis | Core / Half / 3 | Chinese |

Financial Econometrics Analysis | Core / Half / 3 | Chinese |

Options and Futures Markets | Core / Half / 3 | Chinese |

Computer Software Application in Finance | Core / Half / 3 | Chinese |

Multinational Financial Management | Core / Half / 3 | Chinese |

Financial Risk Management | Core / Half / 3 | Chinese |

Seminar on Finance | Core / Half / 3 | Chinese |

Introduction to Natural Science and Artificial Intelligence | Core / Half / 2 | Chinese |

Computational thinking and programming | Core / Half / 2 | Chinese |

English Listening and Speaking in Lab (I) | Core / Half / 1 | English |

English Listening and Speaking in Lab (I I) | Core / Half / 1 | English |

English (I) | Core / Half / 1 | English |

English (I I) | Core / Half / 1 | English |

Chinese Literature Classics | Core / Half / 2 | Chinese |

Literacy and Rhetoric | Core / Half / 2 | Chinese |

Physical Education(I) | Core / Half / 0 | Chinese |

Physical Education(I I) | Core / Half / 0 | Chinese |

Environment Service-Learning(I) | Core / Half / 0 | Chinese |

Environment Service-Learning(I) | Core / Half / 0 | Chinese |

Practical English(I) | Core / Half / 1 | English |

Practical English(I I) | Core / Half / 1 | English |

Presentation Skills in English | Elective / Half / 3 | English |

Investment Banking Management | Elective / Half / 3 | Chinese |

Value Investment: Theory and Practice | Elective / Half / 3 | Chinese |

Microeconomics | Elective / Half / 3 | Chinese |

Financial Planning and Strategy | Elective / Half / 3 | Chinese |

Financial Institutions Management | Elective / Half / 3 | Chinese |

Seminar on Banking Practice | Elective / Half / 3 | Chinese |

Visualization analysis for Business data | Elective / Half / 3 | Chinese |

Introduction to Corporate Sustainability, Social Innovation and Ethics | Elective / Half / 1 | Chinese |

Real Estate Financial Management | Elective / Half / 1 | Chinese |